coinbase vs coinbase pro taxes

Cointrackerio is what you want its the service coinbase contracts to for taxes. Theres different packages you have to buy depending on how many transactions youve had and itll generate.

Capital Gains Tax What Is It And How It Applies To Your Crypto Coinbase

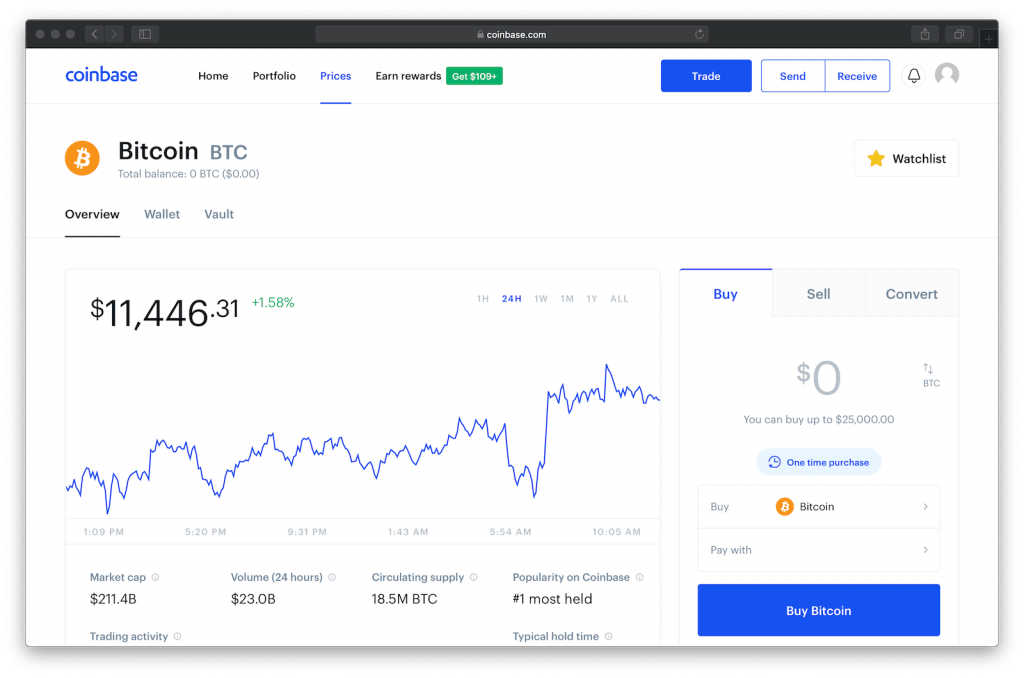

With 247 trading and investment minimums as low as 10 its so easy to get started.

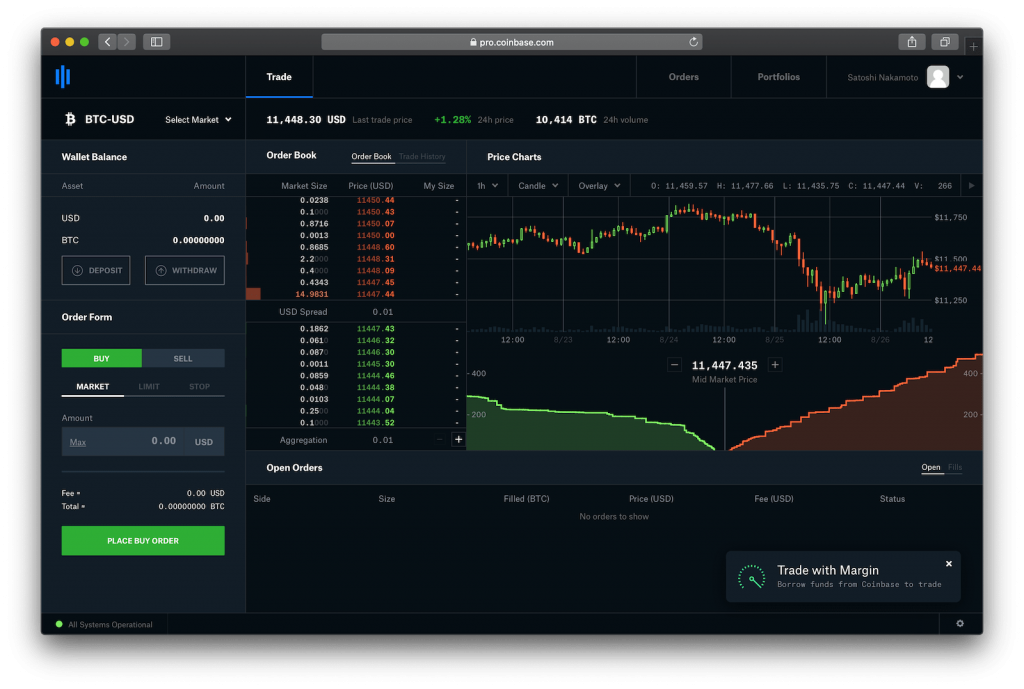

. Coinbase and Coinbase Pro differ in fee structures with Coinbase being more expensive and complicated to understand. Coinbase Pro Vs Coinbase com Coinbase Prime and Coinbase Pro clients for the 2020 tax season. That alone makes Coinbase Pro the better.

Coinbases USD coin USDC is a US. This makes the latter more appealing to serious cryptocurrency. If you do not have a ton of selling transactions you can just enter each line of 8949 manually with your tax sw or paper.

Now as Coinbase rolls out Advanced Trade more broadly all users will be able to use crypto-to-crypto pairs. But it is important to highlight there are wire transfer fees which are a 10 fee. On Coinbase Pro I didnt to anything yet.

Fees on Coinbase Pro are significantly cheaper than fees on the standard Coinbase platform. Coinbase Pro costs less and uses a maker-taker. Bank transfers come with a 149 fee for buying and on the exchange the makertaker system comes with costs of between 01 to 025 depending on the volume you trade.

The premium version Coinbase Pro offers more types of transactions and charges much lower fees and is perfect for active traders. Its free if you have less than 3000 transactions for the year. You can use Cointracker or Koinly to help generate a form 8949 if you.

Coinbase charges a percentage of each sale as a transaction fee with an additional charge levied for credit card purchases. In order to pay 15 tax I plan to hold them for at least 1 year. The higher fees dissuade large-scale.

Dollar-stable coin meaning 1 USDC equals 1. Coinbase Tax Resource Center. Coinbase Pro is cheaper and fees differ based on the amount of the transaction.

I did that and what a. If you mined crypto youll likely owe taxes on your earnings based on the fair market value often the price of the mined coins at the time they were received. The most distinct feature differentiating the two platforms is the fee structure.

Coinbases 1099K form is a kind of consolidated information describing the volume of your trades Exchanges like Coinbase provide transaction history to every customer but only customers. While the Coinbase Pro costs more to buy it has significantly fewer fees than the simpler. 05 fee per trade higher for crypto to crypto conversions plus a Coinbase Fee which is the greater of a flat fee or percentage fee depending on location and.

On a transaction less than 10000 you will pay a taker fee of 060 or. However Coinbase Pro works with some great crypto tax apps - like Koinly crypto tax software - to help you get your Coinbase Pro. The base Coinbase which focuses more on smaller transaction fees charges flat rates at various levels up to 205 before charging a flat 149 fee for anything higher.

If the market maker purchased the retail orders. There are more than 80 trading pairs available on the Pro service. 14 days ago.

Despite being beginner-friendly Coinbase fees can be higher than Coinbase Pro. Ad Invest your retirement funds in Bitcoin Ethereum Solana Cardano Sushi and 150 more. Whereas on the other hand Coinbase is.

I deposited 1000 but didnt buy anything yet. Coinbase Pro has the fee range of 0 to 5 per trade regardless of the traders transaction type. Here is how it works.

No Coinbase Pro doesnt provide a tax report. Coinbase pro is designed for. As many of you might be aware Coinbase is phasing out Coinbase Pro.

Goto cointrackerio and click get started and link your Coinbase pro acc. On Coinbase I bought ETH to hold. They want you to transfer all assets out of Coinbase Pro back to Coinbase.

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

Coinbase Vs Coinbase Pro Is The Upgrade Worth It Zenledger

Coinbase Is Now Your Personalized Guide To Crypto Taxes By Coinbase The Coinbase Blog

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

The Ultimate Coinbase Pro Taxes Guide Koinly

Does Coinbase Report To The Irs Zenledger

Coinbase Learn How To Set Up A Crypto Wallet Youtube In 2022 Learning Wallet Setup

Coinbase Vs Coinbase Pro What The Difference Crypto Pro

/Crypto_Com_Coinbase_Head_to_Head_Coinbase-5a1d16401652466496531dd1cf6e348a.jpg)

Crypto Com Vs Coinbase Which Should You Choose

Coinbase 1099 Guide To Coinbase Tax Documents Gordon Law Group

Coinbase Vs Robinhood Which Is A Better Crypto Exchange Zenledger

The Ultimate Coinbase Pro Taxes Guide Koinly

Crypto Com Vs Coinbase Which Is A Better Zenledger

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

The Ultimate Coinbase Pro Taxes Guide Koinly