how much federal tax is deducted from a paycheck in ma

Your contributions to a tax-deferred retirement plan like a 401k plan should not be included in calculations for both federal income tax or Social Security tax. New construction companies have a.

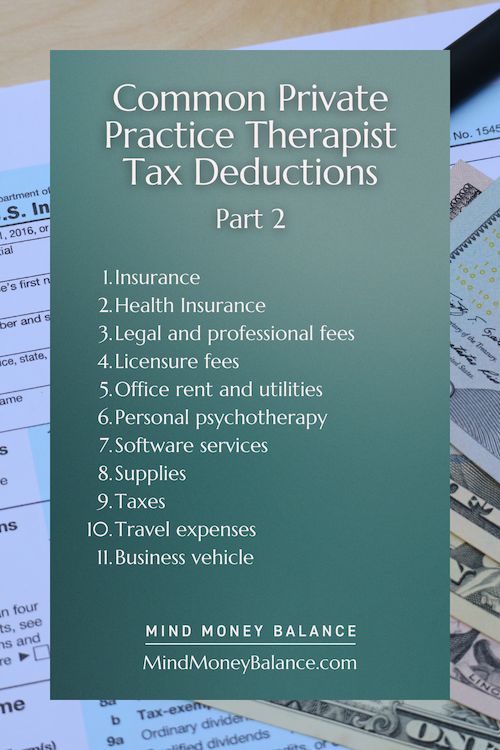

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

The social security tax is 62 percent of your total pay until you reach an annual income threshold.

. Contacting the Department of Unemployment Assistance to fulfill obligations for state employment security taxes. The tax rate is 6 of the first 7000 of taxable income an employee earns annually. 1 were not in fact entitled to the income and 2 have repaid the.

124 to cover Social Security and 29 to cover Medicare. Heres another example. Your employer must deduct some money like taxes and money a court has ordered like child support.

Both also have strict and punitive consequences for an employer found in violation of them. Your employer is only allowed to deduct certain things. State residents who would like to contribute more to the states coffers also have the option to pay a higher income tax rate.

The total Social Security and Medicare taxes withheld. In 2022 if you are a new non-construction business you will pay an assigned rate of 242 for the first. He can take some deductions that you agree to and that you want taken out like an IRA or a health plan.

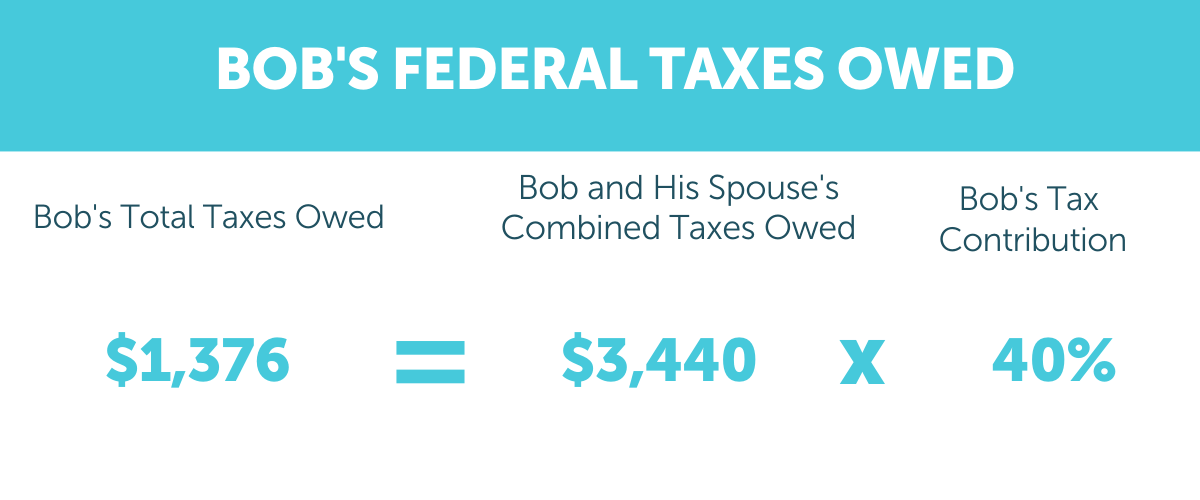

Married couples who file together or individuals who file as the head of a household will pay different paycheck taxes under brackets unique to their filing status. 22 for 40525 - 86375 24 for 86436 - 164925 and so on. 0765 for a total of 11475.

Take home pay for 2022 Its important to revisit your tax withholding especially if major changes from the tax cuts and jobs act affected the size of your refund this year. No local income tax. Rates are generally determined by legislation.

In 2022 if you are a new non-construction business you will pay an assigned rate of 242 for the first three years. Subject to Paid Family and Medical Leave PFML payroll tax. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Taxpayers who have paid Massachusetts personal income taxes in a prior year on income attributed to them under a claim of right may deduct such amounts of that income from their gross income if it is later determined that they. This 153 federal tax is made up of two parts. For the employee above with 1500 in weekly pay the calculation is 1500 x 765.

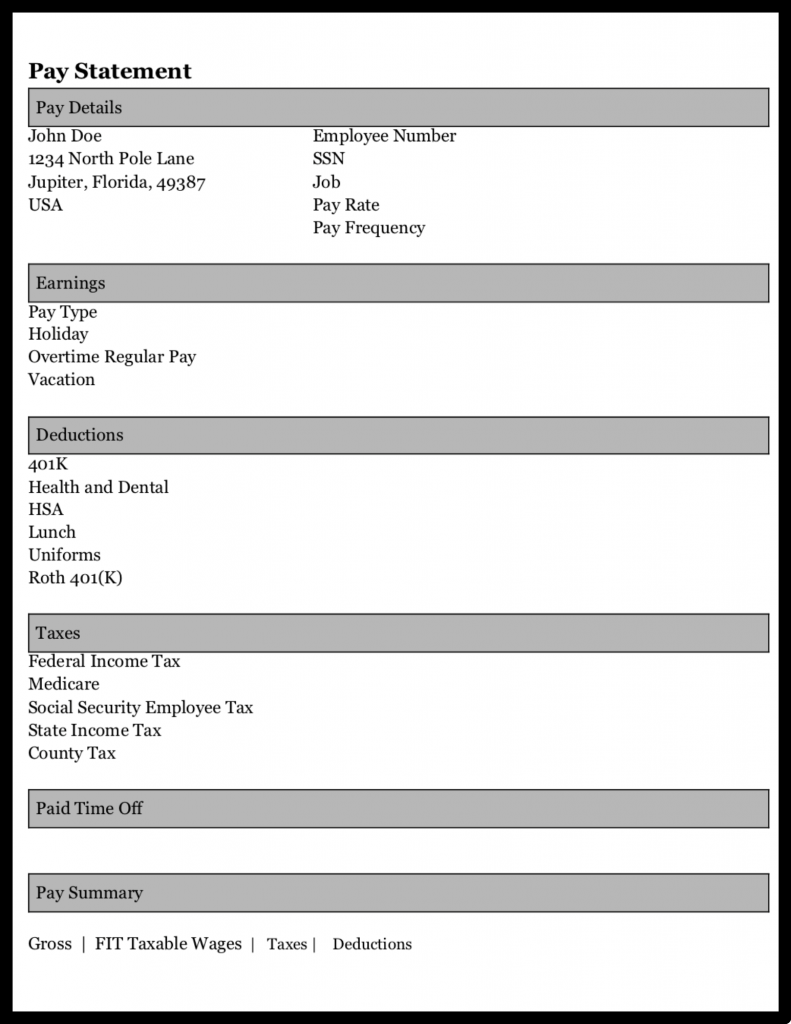

The pay slip must list all the deductions from your pay. The income tax is a flat rate of 5. Rates for 20220 are between 094 and 1437 depending on your claims history.

This tax is paid at the rate of 6 on the first 7000 earned by each employee in a year. For health insurance premiums or. Unlike with the federal income tax there are no tax brackets in Massachusetts.

For unemployment insurance information call 617 626-5075. If a resident of Georgia is earning more than 200000 then an additional tax is also applied on the paycheck called Medicare surtax. The amount of federal and Massachusetts income tax withheld for the prior year.

That rate applies equally to all taxable. Social Security has a wage base limit which for 2022 is 147000. That rate applies equally to all taxable income.

In this 09 more tax is deducted for Medicare purposes. Its important to note that there are limits to the pre-tax contribution amounts. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Learn about the Claim of Right deduction. 4 rows The income tax rate in Massachusetts is 500. For deductions for income tax make sure your employees have signed a W-4 form authorizing the deduction.

Note that you can claim a tax credit of up to 54 for paying your Massachusetts state unemployment taxes in full and on time each quarter which means that youll effectively be paying only 06 on your FUTA tax. Massachusetts Income Taxes. FICA Taxes Who Pays What.

Adjusted gross income - Post-tax deductions Exemptions Taxable income. The income tax rate in Massachusetts is 500. For 2022 the limit for 401 k plans is 20500.

The federal income tax has seven tax rates for 2020. Including common and accepted deductions. These tiers are if you file taxes as a single individual.

On September 30 2021 the Massachusetts Legislature adopted an elective pass-through entity excise tax in response to the federal state and local tax deduction cap of 10000. IRS requires the employer to pay another tax known as The Federal Unemployment Tax Act Tax. Massachusetts is a flat tax state that charges a tax rate of 500.

Able to claim state-level exemptions. Therefore FICA can range between 153 and 162. For employees earning more than 200000 the Medicare tax rate goes up by an additional 09.

Both state and federal laws protect an employees right to wages. Overview of Massachusetts Taxes. This tax is paid at the rate of 6 on the first 7000 earned by each employee in a year.

For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions. IR-2019-178 Get Ready for Taxes. IRS Publication 15 Circular E pages 38-42 has a complete list of payments to employees and whether they are included in Social Security wages or subject.

From your paycheck the total tax constituting FICA is 29 Medicare and 124 Social security of your wages. Social security tax and medicare tax are two federal taxes deducted from your paycheck. Paycheck Deductions Payroll Taxes.

This tax is paid at the rate of 6 on the first 7000 earned by each employee in a year. For tax years beginning on or after January 1 2021 certain qualifying pass-through entities may elect to pay a new-entity level excise tax on qualified. IR-2019-178 Get Ready for Taxes.

The IRS encourages everyone including those who typically receive large refunds to do a Paycheck Checkup to make sure they have the right amount of tax taken out of their pay. Get ready today to.

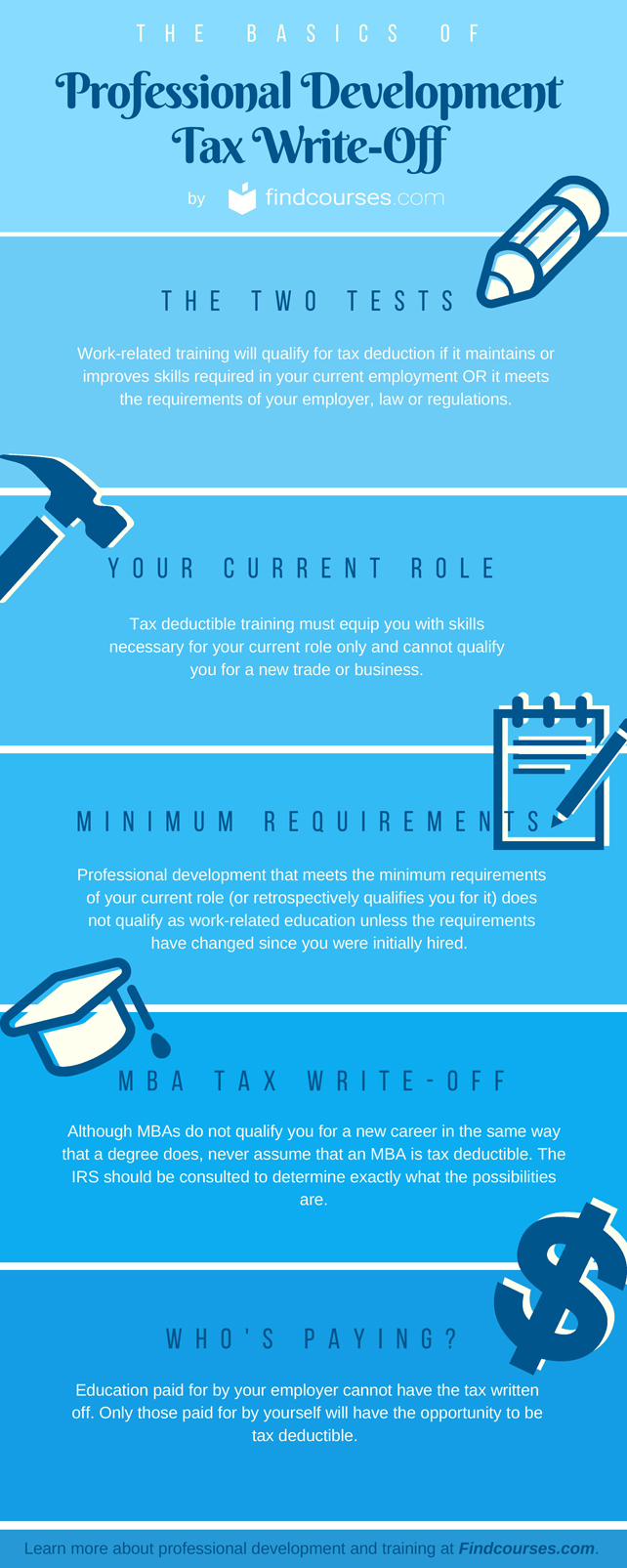

The Professional Development Tax Deduction What You Need To Know

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

What Are Post Tax Deductions From Payroll Types Examples More

What Is The Bonus Tax Rate For 2022 Hourly Inc

A Cheat Sheet For Small Business Tax Deductions Simple Startup

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

6 Common Types Of Payroll Withholdings Deductions

2022 Federal State Payroll Tax Rates For Employers

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

Learn More About The Massachusetts State Tax Rate H R Block

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Tax Deductions For Personal Trainers What Can You Write Off

6 Common Miscellaneous Expenses Examples Tax Deduction Tips For Small Businesses

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Payroll And Tax Deductions Infographic Paycor Hr And Payroll Payroll Taxes Payroll Tax Deductions

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Payroll And Tax Deductions Infographic Paycor Hr And Payroll Payroll Taxes Payroll Tax Deductions

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)